|

When it comes to digital crypto assets Bitcoin is the Gold standard. In a world full of fiat currency, government deficits, inflation and currency debasement, it can be difficult to navigate safely. Bitcoin is the most popular decentralized crypto coin that is not controlled by any central authority and thus cannot be manipulated. A good way to preserve your purchasing power in times of great uncertainty is to buy and hold appreciating assets that historically perform well.

Gold, Silver, Bitcoin and other assets that are limited in supply will always have a certain intrinsic value and therefore cannot be created endlessly as with fiat currencies. Just like buying physical gold and silver bullion, Bitcoin can perform as a hedge against inflation and currency debasement in investment portfolios. |

It is always a good idea to diversify accordingly to manage risk correctly. As with any investment there are inherent risks associated. This is not investing advise as I can only share what I have learned and do personally in my own investment portfolio.

How To Buy Bitcoin (BTC)

There are plenty of ways to acquire Bitcoin and other digital currencies. Some of the most popular exchanges that I have personally used are Crypto.com and Coinbase. Sign up for an account today, verify your identity, transfer funds from your bank to your wallet and buy or sell Bitcoin at will. You will receive a sign up bonus ($25+) for using the links on this page.

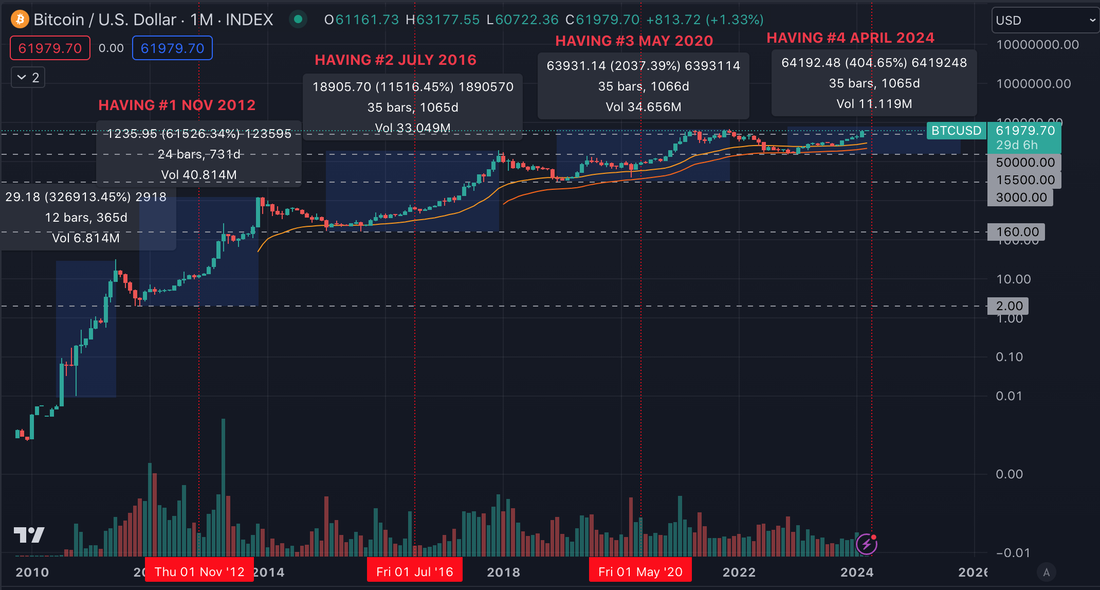

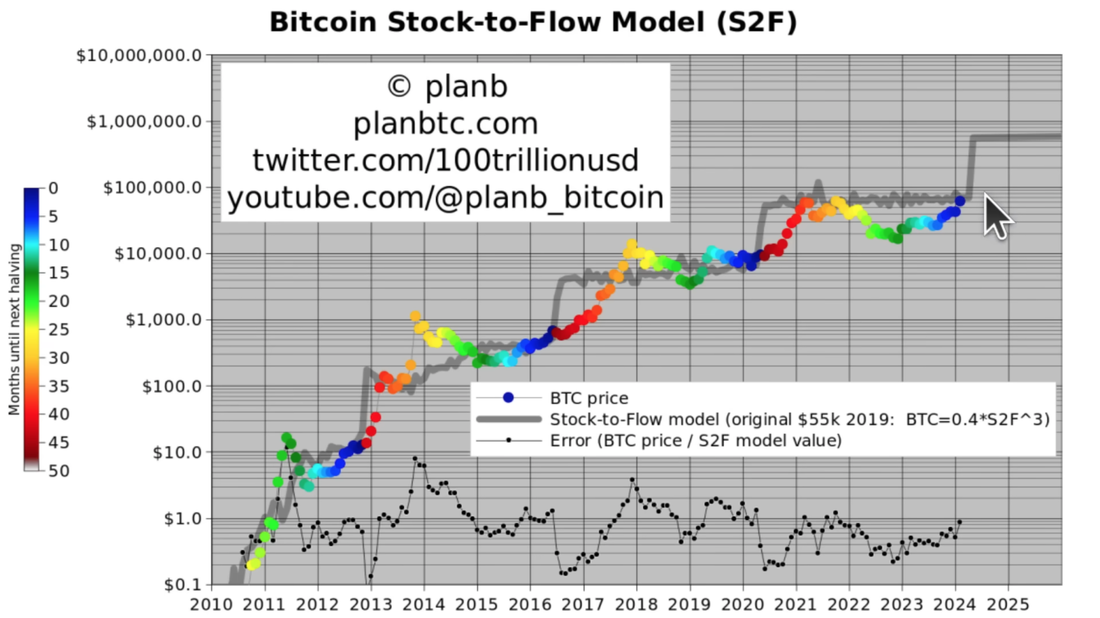

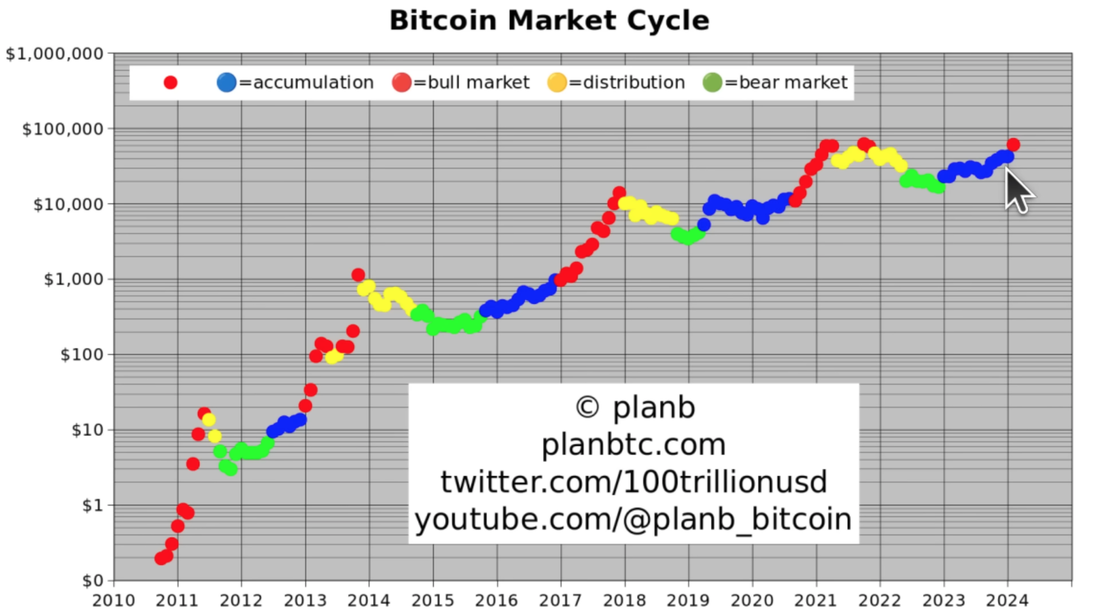

If you want to earn some interest on your crypto investments you can also stake popular coins at Crypto.com. If you want to buy Bitcoin at strategic levels then it is a smart idea to do your due diligence by using the technical analysis meter and charts on this page along with other market expert opinions to help you decide when the right time is to buy and sell your Bitcoin on the exchanges.

If you want to earn some interest on your crypto investments you can also stake popular coins at Crypto.com. If you want to buy Bitcoin at strategic levels then it is a smart idea to do your due diligence by using the technical analysis meter and charts on this page along with other market expert opinions to help you decide when the right time is to buy and sell your Bitcoin on the exchanges.

|

|

The way I like to approach investing in appreciating assets like stocks, gold, silver, bitcoin etc... is generally with a longer term outlook of at least 3 to 5 years into the future. I will also implement a dollar cost averaging approach to accumulate a larger position in an asset over time if I believe it is likely to perform well over the next 3 to 5 years.

Depending on various factors and indicators, I will usually increase the volume of my buying when assets are considered to be undervalued and I will do the opposite when asset prices are overvalued. This strategy enables me to significantly reduce my average cost basis while increasing my equity in appreciating assets over time. Investing is a discipline just like working out or eating a well balanced diet regularly. With a buy and hold strategy such as this I only invest an amount that I can afford to lose / not touch for several years. |

Although Bitcoin is a relatively new store of value, it's price performance since it's creation cannot be ignored. As governments continue to go deeper into debt and debase their fiat currencies, the case for Bitcoin as a legitimate alternate store of value grows stronger by the day. As the internet and e-commerce enables businesses to serve customers on a global scale, the mass adoption of accepting digital currencies as forms of payment is accelerating. Bitcoin is also decentralized, meaning that no government or organization is able to directly control it. These are just some of the reasons why Bitcoin's price is more volatile than traditional assets like gold or silver. As with any investment, it is always important to assess your individual risk tolerances and invest accordingly.